Newsletter #19

Hang around for some Eurocrat propaganda

A word from the person behind the laptop

While it might seem like the world is falling apart around our ears atm, I wanted to take a minute to talk about a more (dare I say) optimistic outcome of the current situation.

Wake-up call number 1.000 for the European Union seems to be the equivalent of iPhones Radar alarm tune that finally wakes us up from the eternal morning snooze.

While “we” (talking for all lawyers here) are nurtured by the the eco-system of laws, rules and stickler-like behaviour there might be a limit to the amount of regulation a union of 27 nation states can stomach - and how scared you can legitimately (pun intended) be of AI at this stage.

In this newsletter, I’ll explain why the future of AI belongs to EU.

Enjoy!

Apparently investors don’t thrive in the jungle?

It’s only been a few years since the EU rebranded itself as the ultimate tech regulator.

The governmental equivalent of Berghain’s legendary bouncer Sven, deciding which tech giants get in, who needs to change outfits, and who’s not welcome at all.

The impersonation of “the Brussels effect”

With (mostly silent) support from the US, Brussels rolled out legislation like the AI Act, Digital Services Act and Digital Platforms Act - and many, many more pieces of legislation that haven’t received the same level of attention.

All meant to curb untamed development of dangerous tech from both Shenzhen and Silicon Valley. The US innovates, China imitates, and the EU… yeah, you know the rest.

Anyway, I recently joined the OpenAI Forum and took part in a discussion with economist David Autor - and I have to say I agree with his view on the progress of AI deployment.

It’s a slow, but steady process where humans and organisations will have to adapt step-by-step and where the long-term gains are likely to land with the middle class, not just the top 1%.

In my view, this kind of gradual, structural adoption actually plays to the EU’s strengths. Especially if we can swap the current anxiety about AI for a bit of strategic curiosity.

Because right now, the EU has a real chance to become a safe zone for capital. If the US continues to spiral into regulatory whiplash and political volatility every 72 hours, then investors who thrive on predictability and rule of law, not chaos, will start looking for alternatives.

Don’t get me wrong. I admire the US for its ability to reinvent itself and investments will of course continue, but I believe that the underlying volatility (economically and legally) could make the EU more attractive on at least three fronts:

a. Talent may increasingly prefer to stay in - or move to - the EU

b. make it more attractive for investors to invest in EU based companies, and

c. the EU will (finally) be forced to build its own infrastructure. Not just to support AI, but to underpin a broader digital ecosystem (not relying on unreliable partnerships).

If this sounds like a fever dream then just gimme a sec to explain why things are already pointing in this direction:

a. The Niels Bohr effect - but for tech

Being a proud Dane I have to point towards the example of physicist Niels Bohr. Yes, Bohr was a brilliant physicist. But what’s less known is that he had an additional talent which was… attracting other talent. He basically turned Copenhagen into a global centre of quantum research in the 20th century.

Today Silicon Valley has basically vacuumed up European tech talent with a combination of cutting-edge work, cult-like optimism, and compensation packages that redefine the word “income.”

But luckily it’s not just about the paycheck. Talented people want to work on problems that matter. They want to be around other talented people. They want momentum. Silicon Valley knows this and constantly comes back to this idea (for good reasons).

Perhaps Niels Bohr laid out an example for the EU to follow

If you’re at the forefront of software innovation in the EU, UK, Australia etc., you’re most likely in California or trying to get there. I’ll leave out hardware, where the EU actually has a stronger foothold than what it gets credit for (just look at ASML, the Dutch company that makes the most advanced chipmaking equipment in the world).

The EU has known for years that it has a talent problem in this type of tech. And it has tried (mostly half-heartedly in my opinion) to fix it. But the problem with talent is that it accumulates exponentially. Once one tech cluster gains critical mass, the rest tend to get hollowed out. So reversing that trend is hard.

Still, there’s reason to be (cautiously) optimistic. The AI Innovation Package, published in January 2024, includes a commitment to international recruitment of AI talent, and the rollout of targeted education and training programs in priority sectors.

The real test will be whether Europe can build gravitational centres of AI innovation.

Right now, Mistral (France) is probably the one to watch. Yes, it’s mostly funded by US venture capital (lol), but it’s headquartered in France and building open-source models that punch well above the average EU weight.

The Stanford University index actually has 25 of 101 EU-based “notable AI models” on their list - but I guess the real question is how many of these you can mention? Whether companies like Mistral can attract global talent will be a key signal of whether Europe can hold its own.

That said, if you listened to the Hard Fork podcast’s report from the Paris AI conference, it wasn’t exactly a confidence boost. The vibe was… let’s call it “early days.” Not the kind of thing that makes a Stanford student move to Sorbonne. But I respect that these things take time - and frankly, France is doing more than most.

Plus Europe ticks the box in for a very important factor: Affordable, world-class technical education + better food. If the EU can combine that with regulatory clarity, ambitious tech hubs, and just a bit of vision, then yes, it could start reversing the talent drain.

b. Brussels is more predictable than Palo Alto (and that might be a good thing these days)

I highly recommend Nate Silver’s new book, On The Edge, which takes a deep dive into the psychology of risk. One of its most compelling themes is the risk culture of Silicon Valley, which, for better or worse, has become foundational to how tech companies operate (and occasionally implode).

That same risk culture has shaped everything from the way startups raise capital to how the Valley engages with politics. Case in point: Silicon Valley’s increasingly warm embrace of Donald Trump, who some (Marc Andreessen among others) see as a deregulation goldmine.

Maybe that gamble pays off. Maybe it doesn’t. But if you’re an investor looking for long-term clarity, betting on political chaos isn’t exactly a sound strategy.

I’ve been following Silver’s tech stock tracker. An overview of how major Silicon Valley-linked companies are reacting to market shifts and election-year uncertainty. So far, the signs are… mixed.

According to Nate Silver’s Silver Bulletin newsletter, 37 of the 50 companies in the SV50 (the 50 largest companies in Silicon Valley) have declined more than the Dow Jones Industrial Average since Inauguration Day, and two-thirds have fallen more than the S&P 500.

Meanwhile, back in Brussels there’s something investors are starting to appreciate more and more: predictability (or at least MORE predictability than the US)·

The EU might not move fast. But it moves in a straight line. It offers regulatory certainty, rule of law, and a coherent legislative process that doesn’t depend on whoever’s trending on Twitter that week.

Even some of the EU’s big fines - Meta, Apple, take your pick - look less arbitrary in this light. Yes, Mark Zuckerberg recently told Joe Rogan that EU fines are “similar to tariffs,” which hurts my legal pride.

To be clear: A tariff is a cross-border trade barrier/tax. A regulatory fine is the price of failing to follow laws that (in theory) apply to everyone equally. The issue isn’t protectionism: it’s clarity. And clarity seems to finally be improving.

If Europe can stay the course pairing long-term investment with legal transparency it may become the Western Hemisphere safe bet for global capital looking for exposure to AI and digital infrastructure.

In other words: Brussels might be boring. But right now, boring is bullish.

c. Infrastructure is not a joke

Since the Russian invasion of Ukraine, infrastructure has been on everyone’s lips in Europe. All of a sudden, it clicked: the entire continent’s energy system was built on the assumption that geopolitical stability was a given and that a gas pipeline from an increasingly authoritarian regime was a perfectly reasonable way to power your economy…

Nordstream 2 has become a strong symbol of… failed infrastructure

And while (fairly annoying) EU tech compliance people have been yelling into the void for years about our total reliance on US tech infrastructure (cloud, chips, satellite comms, even productivity software) it’s only now, in 2025, that the full consequences of that overdependence are hitting home.

What happens when the US enters a full-blown trade war with China? Something that seems to already be happening in front of our eyes. Will the EU be forced to “choose sides”? What happens when a single US-based cloud provider or AI service changes its API terms, pricing, or access policies overnight?

We might be close to a future where AI services as integrated into our societies as cloud services are today. What happens when entire sectors of your economy transport, health, education can’t function without infrastructure decisions made in Palo Alto or Seattle?

Germany might have been right in printing and faxing documents all along.

According to the Draghi report on competitiveness, the EU must now focus on three key infrastructure pillars:

1. Compute capacity,

2. Trusted cloud infrastructure, and

3. Telecoms and satellite networks.

Satellite comms is increasingly interesting and may prove to be a powerful tool. The current political situation makes EU push even harder for an alternative to Starlink. The French are (yet again) offering the best alternative at the moment. No one in Europe wants wartime communication to depend on the current mood of Elon Musk tbh.

Infrastructure is the foundation for everything else. And will be increasingly important with the deployment of AI… everywhere.

If the EU actually wants to shape the future of AI, it needs to stop renting space in someone else’s basement and start building its own house. Now!

In other news…

OpenAI launches new “agentic” models

OpenAI released o3 and o4-mini, its most capable models yet. They can now independently use all tools in ChatGPT (code, web, file analysis, vision, image generation) to tackle complex, multi-step tasks.

Nvidia hit by $5.5B China export blow

Nvidia shares dropped 7% after the US restricted sales of its H20 AI chip to China. The chip now requires a federal license “indefinitely,” as tech decoupling escalates.

IBM debuts smarter, smaller LLM

IBM unveiled Granite 3.3, its first official speech-to-text model, supporting eight languages. It includes hallucination-mitigation tools and fill-in-the-middle capabilities. Especially useful for code generation.

Start-up of the week

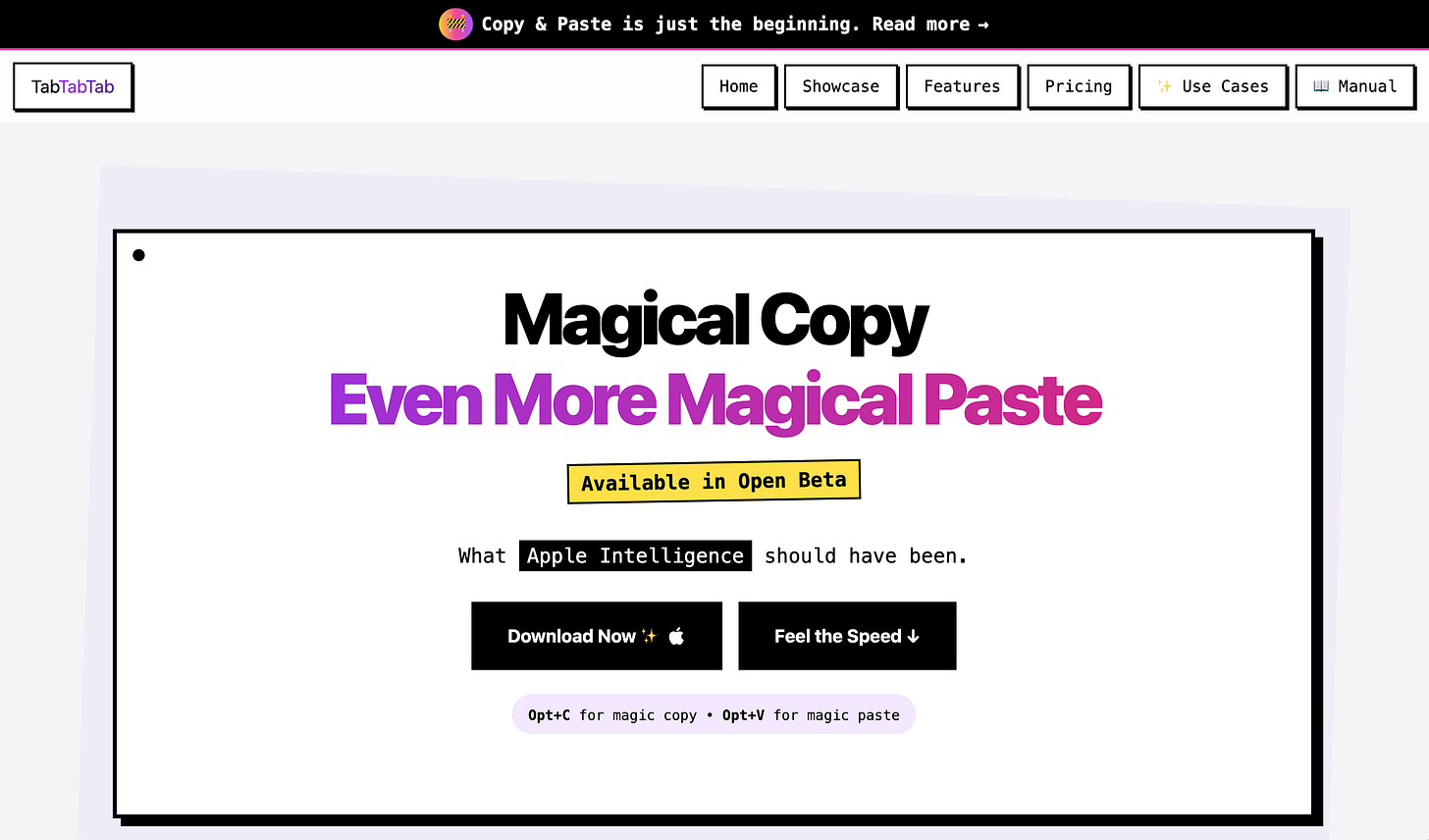

This is not strictly a legaltech tool, but its definitely useful for lawyers. I’ve been using TabTabTab it quite a lot for the last week and I think there are many good use cases. Not gonna try to explain, but just try it out. It takes copy/paste to the next level.

Extra toppings

Nintendo might decide who wins the midterms